Introduction: The Capital Conundrum

Access to capital is one of the most persistent and painful struggles for business owners across North America. Whether you’re running a lean startup, growing a family-owned operation, or scaling a high-potential venture, business financing can feel frustratingly out of reach—especially when you need it the most.

Far too often, businesses wait until they’re facing a cash flow crisis before seeking financing. But by the time that alarm bell rings, lenders may consider them too risky. This leads to missed opportunities, strained operations, or worse—closures that could have been prevented.

The First Problem: Too Late, Too Risky

It’s a tough truth: when you’re desperate for capital, you’re least likely to qualify for it.

Banks and financial institutions assess risk based on financial history, stability, and projections. A business experiencing a revenue dip, mounting receivables, or short-term payroll pressure may find it hard to demonstrate its creditworthiness—even if the problem is temporary.

Proactive financing is about being prepared before you’re pressured. That means having the right systems, teams, and financial mindset in place long before a lender comes knocking.

The Second Problem: It’s Not Just About the Numbers – Communication is Everything

One of the most under-appreciated skills in securing financing is clear communication. Having strong financials is necessary, but not sufficient. You must be able to tell the story behind the numbers—with clarity, confidence, and strategy.

Ask Yourself:

- Can you explain what your business does in 30 seconds or less?

- Can you articulate your funding need and exactly how funds will be used?

- Do you have a realistic forecast and a plan for ROI?

- If you’re experiencing a downturn, can you explain why—and what corrective actions are underway?

Whether you’re pitching to a bank, a private lender, or a grant committee, your ability to connect the dots between capital and outcomes is crucial.

Pro Tip: Create a short financial narrative: a 1–2 page document that outlines your company’s growth history, purpose, financial trends, and strategic vision for the next 12–24 months. Pair this with data, but lead with the story.

Crafting the narrative: Financial Literacy Is the Missing Key

Too many entrepreneurs focus exclusively on sales, product development, or marketing—while financial literacy lags behind. But if you don’t understand how money flows through your business, you can’t expect to manage it well—let alone convince a lender to trust you with more.

What Does Financial Literacy Look Like?

- Understanding key financial statements (P&L, balance sheet, cash flow)

- Knowing your break-even point and gross margin

- Projecting capital needs in advance

- Tracking KPIs like customer acquisition cost (CAC) and lifetime value (LTV)

- Recognizing early signs of financial distress

Tip: Even if you’re DIY-ing your books, take time to upskill. Free courses from organizations like the BDC, SBA, or Coursera can make a huge difference.

From DIY to CFO: When to Build a Finance Function

You don’t need a full finance department on Day 1, but you do need a CFO mindset from Day 1.

Here’s a smart progression:

Stage 1: DIY Bookkeeping with a CFO Mindset

- Use tools like QuickBooks, Wave, or Xero

- Categorize expenses correctly

- Start forecasting early

- Get tax-compliant

Mindset: You’re not “just doing books”—you’re building visibility into how your business performs.

Stage 2: Hire a Bookkeeper and Financial Advisor

- Outsource bookkeeping to save time and reduce errors

- Work with a CPA or financial coach quarterly

- Conduct monthly financial reviews

Mindset: You’re the CEO. Start managing money like a portfolio, not a piggy bank.

Stage 3: Bring in a Fractional CFO

- When planning to scale, take on debt, or attract investors

- Use a fractional CFO for fundraising, modeling, and strategic planning

- Great for $500K–$5M revenue businesses

Mindset: You’re building infrastructure for sustainable growth.

Stage 4: Build a Permanent Finance Team

- Ideal at $5M+ or when managing complex financing, multiple business units, or M&A

- Roles: CFO, Controller, Analyst, Accounts Payable/Receivable

- Focus shifts from survival to strategy

Mindset: Finance isn’t overhead—it’s an engine for performance and risk mitigation.

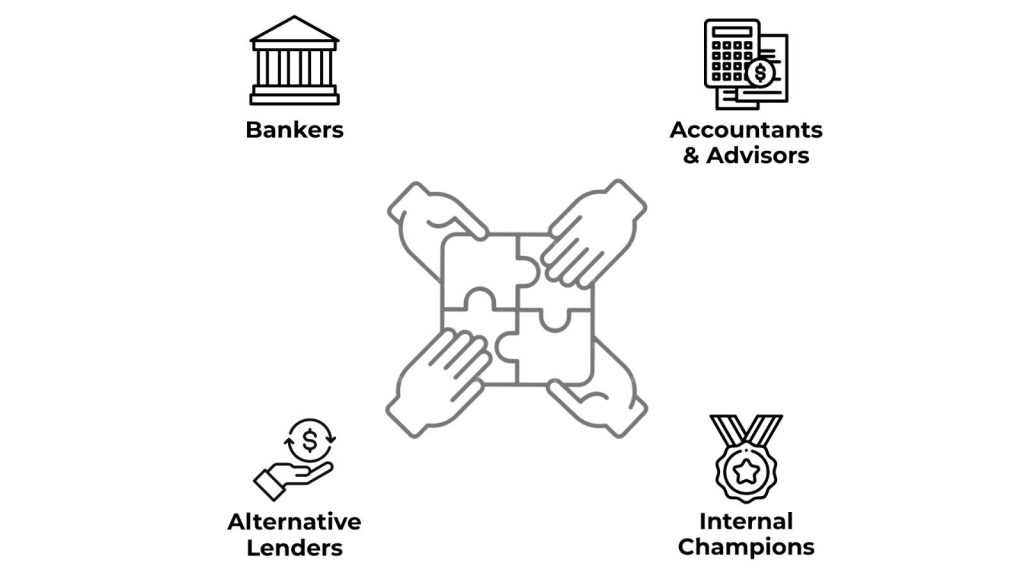

Relationships Matter: Cultivating Financial Allies

A big part of getting approved for financing is who you know—and who knows your business.

Build Financial Relationships Early:

- Bankers: Open a business account with a local institution and check in regularly

- Accountants and Advisors: Share your goals and ask for feedback proactively

- Alternative Lenders: Keep options open beyond traditional banks

- Internal Champions: Train your operations manager or assistant to understand basic finance—don’t silo the numbers

Pro Tip: Strong relationships often yield better terms, faster decisions, and more flexibility in challenging times.

Financing Options for North American Businesses

You have more options than you think:

- Lines of Credit

- Government Loans & Grants (e.g., SR&ED, CanExport, SBA 7(a))

- Invoice Financing & Factoring

- Revenue-Based Lending

- Venture Debt or Convertible Notes

- Crowdfunding or Equity Platforms

Learn about platforms like FundThrough, Clearco, or Lendified to compare alternatives that align with your industry and growth plans.

Final Thoughts: Think Like a CFO Even If You’re a Team of One

Being finance-savvy is no longer optional. Whether you’re a solopreneur or running a $10M company, having the mindset—and eventually, the infrastructure—of a CFO can dramatically improve your access to capital, profitability, and resilience.

Want Help Building Your Business?

At Launch & Prosper, we support entrepreneurs in management, finance and communication strategies that attract funding, improve operations, and build long-term wealth. Let’s talk about how to future-proof your finances.

📩 Contact Us or explore our tools at www.launchandprosper.ca